Last week could be split in half really. Bullish 1st half and much worse 2nd half. Here’s what was up in short:

Last week

-> Monday kicked off with a positive tone on the back of high-techs coming back from the previous week’s dismal underperformance. We also heard positive data on the Pfizer/BioNTech and Oxford University/AstraZeneca covid-10 vaccine candidates. Investors also talked about the next fiscal stimulous bill, which kept up hopes for another boost for markets.

-> On Wednesday Pfizer and the US government struck a deal on delivey of 100m doses of their vaccine, if it proves safe for humans. The deal was as big as $2bn.

-> Meanwhile the good-old story of US-China relations came back on tape. US State Department 1st told to close the Chinese consulate in Houston, which was not left unoticed by China, which later retaliated with closing US consulate in Chengdu.

-> Scheduling firm Homebase data showed on Tuesday what was then confirmed on Thursday, namely that the pace of labour market recovery is slowing down. Thursday’s weekly jobs report turned out worse than expected indeed and looked as follows:

-> The cummulation of news from the labour market and the political front caused a sell-off on Thursday, which took SP500 down over 1% and snapped a 4-day winning streak. Tech shares led the market down in general (Nasdaq -2.2% on Thursday even). Even Microsoft (MSFT) dropped over 4%, despite good 2q20 numbers.

-> On Friday shares of Intel (INTC) plunged 16% after saying its next-generation chips will come out 6 months later than expected. INTC’s numbers themselves (announced thursday after close) were a beat both on revenue and EPS level. Icreasing fears of INTC’s disadvantegous position vs. its rivals like AMD made some Wall Street analysts throw in the towel and downgrade INTC. The stock is a part of our GLP portfolio. Revisions are made yearly and current announcement does not most possibly change INTC’s rating in SIAScore, but it needs to be watched in longer run on how INTC’s position changes. On the other hand AMD is also a part of GLP and the stock surged by 16% to record close.

-> Effective weekly index changes: S&P500 -0.3%, Nasdaq -1.3%, EuroStoxx600 -1.5%, DAX -0.6%, Nikkei225 -0.9%.

Other markets events:

-> Bonds: US yield curve (10y-FF) narrowed to 0.5%, German curve (10Y Bunds-3M) finished at 0.1% with 10Y Bunds at -0.45%, High Yield Spreads keep narrowing recently an finished at 5.2.

-> Commodities (ex oil): Gold finally broked the crutial $1800/ounce level and pushed towards $1900/ounce ending +4.9% on week – gains were fueled by weaker dollar, political uncertainties on the China-US front again and weaker equit markets.

-> Currencies: DXY (Dollar Index) weakened substantially last week -1.6%, EURUSD +2%. DXY now trades around 94 level, which is at it its long-term support trendline (see below) – needs to be watched closely here in my view for signs of either continuation or a break of an almost decade long trend of stronger dollar, especially given the current post-Covid situation of much lower rates differential between USD and other major currencies like EUR.

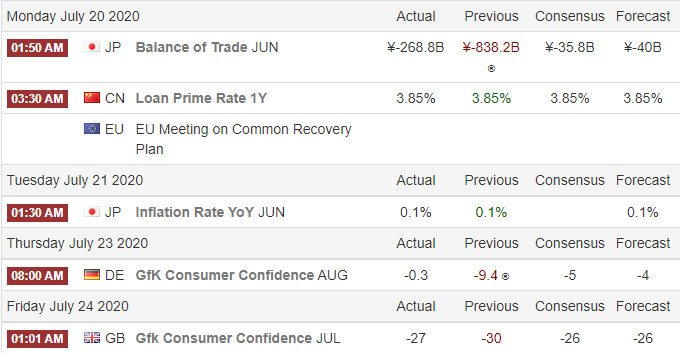

Major macro events: (times are CET):

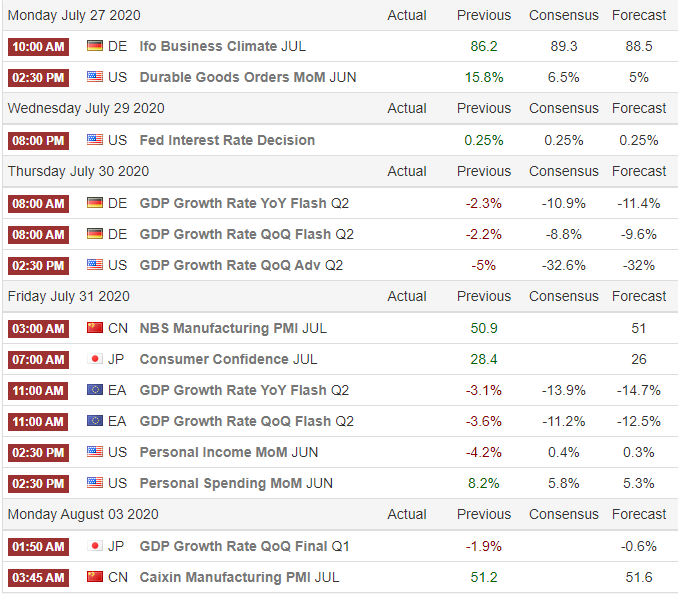

Next Week’s major macro events:

Yours!

PC

Disclaimers: None of the ideas, views and thoughts presented here shall ever be taken as a recommendation to buy or sell stocks,bonds,FX,commodities or any other financial instruments as stated in REGULATION (EU) No 596/2014 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC or the Regulation of the Polish Minister of Finance of 19 October 2005 on information constituting recommendations regarding financial instruments, their issuers or exhibitors (Journal of Laws of 2005, No. 206, item 1715) or the Polish Act of 10 February 2017 amending the act on trading in financial instruments and some other acts. The article is for educational reasons and purely presents private views of the author, thus the author shall not be claimed eligibile for any losses of a third party resulting from trading activities based upon this article. The author uses his best knowledge and data from sources believed to be reliable, but makes no representations as to the accuracy of the data.Full Disclaimers&Liability Limitations page.