Table of Contents

In this post I explain major drivers for both the global markets and our Global Leaders Portfolio (GLP) for November 2020. Then I move on to a short reminder of how we’re going to proceed once we enter the new phase of the economic cycle once it comes and how the nature of the portfolio will change. This is followed by an analysis of the portfolio’s qualitative characteristics. The usual month-end rebalancing of the GLP is also conducted.

What a month it was for the markets! Equities have not seen such strong gains November since 1987. The major indices gained 9-12%. The rally was fueled by two major drivers:

👉 The biggest risk event – US Presidential elections – brought a relatively clear win of the Democratic candidate Joe Biden. What’s important is that there was no prolonged recalculation of votes needed and Mr. Trump decided to give in pretty quickly and acknowledged his defeat. In my personal view it is the quickness of the election and not the outcome itself that spurred the rally broadly. The markets clearly wanted to move on and they got a clear message fast as to who will rule in the next four years. Also, the fact that there’s still a balance in the Senate from the Republican side assured the investors that there’s very little risk for any more controversial plans of the Democratic administration. Effectively we got a more forseeable President and a balanced situation in Washington. Seems like a sweet spot for Wall Street.

👉 The vaccine news. Over the last three weeks of November we had confirmation from three different sources (Pfizer (PFI) and BioNTech, Moderna (MRNA) and AstraZeneca (AZN) and Universityof Oxford) of a 90%+ effective Covid-19 vaccine. This resulted in a burst of expectations for a quicker and easier path to Recovery. Risk-on sentiment was the effect and a huge rotation into the virus-hit sectors happened. Stocks of Cruiserlines, Airlines, Hotels and Energy companies have skyrocketed. The whole world’s old economy sectors also rallied of course. Just to name one case here: Lyxor STOXX Europe 600 basic Resources UCITS ETF return in Nov was up as much as 20%. High-Techs initially retreated as they have been the most crowded longs over the last months, but after most of the rotation took place, this sector also joined the broad rally. Additionally utility commodities rallied higher, precious metals retreated. Oil up almost 25% on month, copper up almost 15% on month, Gold down 7% on month. The yield curve kept steepening in general from 70bps-ish in Oct to 80-90bps in Nov. The Dollar Index (DXY) lost almost 3% on month. A typical risk-on environment.

The impact of all the above trends had a two way effect on our GLP. On one hand the risk-on hurt the Gold (GLD) bullion holdings, which currently stand at over 30% of the portfolio (it is still in a recession-typical asset allocation mode: Equities max 20%, long-term Treasuries (TLT) 35%-40%, Gold (GLD) 30%, Cash 10-15% – more below on how and when it will change). The GLD part of GLP is down over 5% for the month. On the other hand though, our relatively small allocation in equities (20%ish) delivered a gain of as much as almost 12% on month. This easily balanced the negative GLD effect. The Treasuries part of the portfolio was stable on month delivering a slight gain of appx. 1.5%. This is the beauty of Smart Investing Approach (SIA)! The fact that the portfolio is always exposed to the 4 major asset classes with proportions appropriate to the cycle phase gives a perfect balancing effect. Let’s remind again, all the 4 asset classes have 0-to-negative correlation coefficient.

What will change and when

Every Smart Investor knows that the SIA follows (a) specific economic cycle allocation pattern (b) specific stock picking system (SIAScore).

As to the point (b) we’re still in the process of further diversification of the equity part of the portfolio. Current count of stocks is 14. All of them fulfill the SIAScore. I plan to be on the look for further candidates, but the portfolio will rather stay a concentrated one. I think the eventual number fo stocks withing GLP will be between 15 and 20. Rather not more than that. This month we’re not changing the composition of equities by the way.

More interesting stuff to come is rather in the point (a) in the forseeable future. Once we have a phase change signal from the Enhanced Aggregate Spread (EAS or Mr.Model) the allocation of equities will be constantly increased to a targetted level of 50-70%. This level will be kept untill Expansion phase, when it will be capped to 60% and kept so untill the Boom phase. In the Boom equity weights will keep dropping systematically down to appx. 20% at around the next peak of the cycle. A 0-20% equity allocation rule will prevail thruough out the time of the next Recession.

When will we have a cycle phase change signal? We don’t know that of course. The current events we experienced in November put us surely closer to a Recovery phase. What is now needed is mostly a continued improvement in the labour market. My bet would be for 1H21 (with inclination towards 1Q21), but we want to depend on the signal and data, rather than speculation. Until then GLP patiently stays with a 20% equity allocation. Those of you keen to investigate EAS in more details shoudl shurely drop by www.nospinforecast.com and consider purchasing one of Dr.Dieli’s subscription options. It is really worth the money.

Let’s more on now…

GLP portfolio characteristics

Just as a reminder: you can always find the table with main portfolio quality characteristics unther the Portfolios subpage for the current structure of both GLP and the Pension Portfolio (PP).

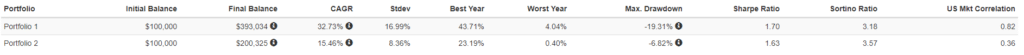

Here I wanted to make a quick exercise showing how the characteristics will change when we move from Recession into Recovery. The move will happen once our macro forecasting tool (the Enhanced Aggregate Spread) gives the appropriate signal. Below you can see the main quality stats for the last 5-year period for GLP in two cases. Case one (Portfolio 1) is the GLP with current set of stocks, but a maximum potential Recovery-specific equity allocation of 70%, minimum possible weights in GLD and TLT of 15% each and close to zero Cash. This is of course an extreme case. The point is to show how such a portfolio would have behaved for the last 5 years. Such a period is very short for statistical purposes, but some of the the stocks (like SQ and SEDG) have no longer listing history. Have to work with what we got. Case number two (Portfolio 2) is the GLP in current state. Take a look at the table:

And here are the basic observations, which are crutial:

👉 The Sharpe Ratio and Sortino Ratio (you can find the explanations of both here and here or under the Portfolios subpage here) do not differ much and are at excellent levels in both cases. This indicates that the SIAScore (our stock selection system) and the diversification of the equity portfolio adds value per one unit of risk (standard deviation).

👉 Neither of the portfolios had a down year over last 5 years.

👉 Bigger equity allocation for Portfolio 1 resulted in bigger risk than in Portfolio 2, but accompanied by respectively bigger returns, resulting in the Sharpe and Sortino remaining at similar levels.

👉 These characteristics include a Recession period. If the last 5 years did not cover a cycle peak (but only Recovery or Expansion instead) the returns, drawdowns and ratios would possibly look even better.

The general conclusion here is that SIA and SIAScore both complement each other and produce a good quality mix of assets. Once we’re finally in Recovery and Expansion, one should not be afraid of high equity allocation.

OK, let’s see the end-of -Nov portfolio changes…

The Rebalance

The GLP gained over 1% since the last rebalancing as of end October 2020. Let’s see how the constituents performed last month:

-> TLT was up 1.5% since the last rebalancing. TLT’s impact on GLP +55bps.

-> GLD lost over 5% in November as investors rushed into equities and safe havens were in retreat. On a net-net basis GLD is down 5.4% since 5th Oct (impact on GLP -170bps).

-> The equities portfolio rose 12% in November (impact on GLP +240bps). In that time range S&P500 is +9.4% and Nasdaq +11%.

Here are the trades done this month: due to a substantial gain in equities their weight in the portfolio rose to 22%. I am trimming the ones with biggest weights currently: Square (SQ), Garmin (GRMN), AMD, Nvidia (NVDA) and Booking Holdings (BKNG). The proceeds are used to buy the dip in GLD.

Portfolio holdings are traded at the closing price on the rebalancing day presented by www.morningstar.com (which may differ from official closing prices given by appropriate stock exchanges).

Current structure of the GLP can be found on Portfolios page.

Total Personal Return since inception (TPR) of GLP as of close 30th October 2020: +14.4%.

Next update in a month.

Yours,

PC

Disclaimers: None of the ideas, views and thoughts presented here shall ever be taken as a recommendation to buy or sell stocks,bonds,FX,commodities or any other financial instruments as stated in REGULATION (EU) No 596/2014 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC or the Polish Act of 10 February 2017 amending the act on trading in financial instruments and some other acts. The article is for educational reasons and purely presents private views of the author, thus the author shall not be held accountable for any losses of a third party resulting from any potential trading activities in any instruments, both specifically or by category of assets. The author uses his best knowledge and data from sources believed to be reliable, but makes no representations as to the accuracy of the data.Full Disclaimers&Liability Limitations page.