Table of Contents

In this article I write about the most important market developments for August 2020 and their impact on our SIA-style portfolios and proceed with the end-of-month rebalancing for GLP. The PP portfolio rebalance is explained in a separate post. Let’s get to it…

August like no other

This year is just so much different than any other. Marktes saw an almost 40% plunge and a stunning comeback all the way back up to new all time highs in the middle of a -20-30% GDP recession. All this happened within a span of less than 7 months. And so quite naturally also August was different this year. Here’s a short list of unusual developments that happened last month:

-> Volatility was in full retreat, although August quite often sees increased nervosity. I wrote about the recent instances of August shocks in short here. This year, given all the supportive policies implemented both by the central banks around the world, as well as the governments, August actually turned out to be the month when SP500 broke to all-time highs. VIX index, the measure of implied equity market volatility, hovered around its lows for the whole Covid-19 recession period around 20-27 pts.

-> Performance wise August was stunning. SP500 ended 7% up on month, Nasdaq +9.6% on month and the Dow +7.6% on month. Effectively it was the best August sine 1986. Another historic development.

Here’s a 30-year monthly logarythmic graph of SP500:

The 37% February-March drop starts looking like little blip huh?

The Fed’s message

To me personally the biggest development for the month of August was the Jackson Hole speech by Fed Chair J.Powell. I mentioned it here in my latest Weekly. The full speech can be found here. And here’s the most important excerpt:

“In earlier decades when the Phillips curve was steeper, inflation tended to rise noticeably in response to a strengthening labor market. It was sometimes appropriate for the Fed to tighten monetary policy as employment rose toward its estimated maximum level in order to stave off an unwelcome rise in inflation. The change to “shortfalls” clarifies that, going forward, employment can run at or above real-time estimates of its maximum level without causing concern, unless accompanied by signs of unwanted increases in inflation or the emergence of other risks that could impede the attainment of our goals.25 Of course, when employment is below its maximum level, as is clearly the case now, we will actively seek to minimize that shortfall by using our tools to support economic growth and job creation.

We have also made important changes with regard to the price-stability side of our mandate. Our longer-run goal continues to be an inflation rate of 2 percent. Our statement emphasizes that our actions to achieve both sides of our dual mandate will be most effective if longer-term inflation expectations remain well anchored at 2 percent. However, if inflation runs below 2 percent following economic downturns but never moves above 2 percent even when the economy is strong, then, over time, inflation will average less than 2 percent. Households and businesses will come to expect this result, meaning that inflation expectations would tend to move below our inflation goal and pull realized inflation down. To prevent this outcome and the adverse dynamics that could ensue, our new statement indicates that we will seek to achieve inflation that averages 2 percent over time. Therefore, following periods when inflation has been running below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.“

This means that:

-> The Fed will do everything to anchor peoples’ expectations of higher inflation going forward. And thus…

-> …With the Fed’s clear message of planning to keep rates at current levels for as long as needed to support the economy (accompanied by limitless QE), investors should prepare for an extended period of negative real rates (a situaiton of inflation running above short term interest rates).

-> Negative real rates usually mean a chase for returns, supporting stocks (historical longer-term EPS growth around 6-7% becomes an even more attractive option for investors) and commodities (as inflation hedgers).

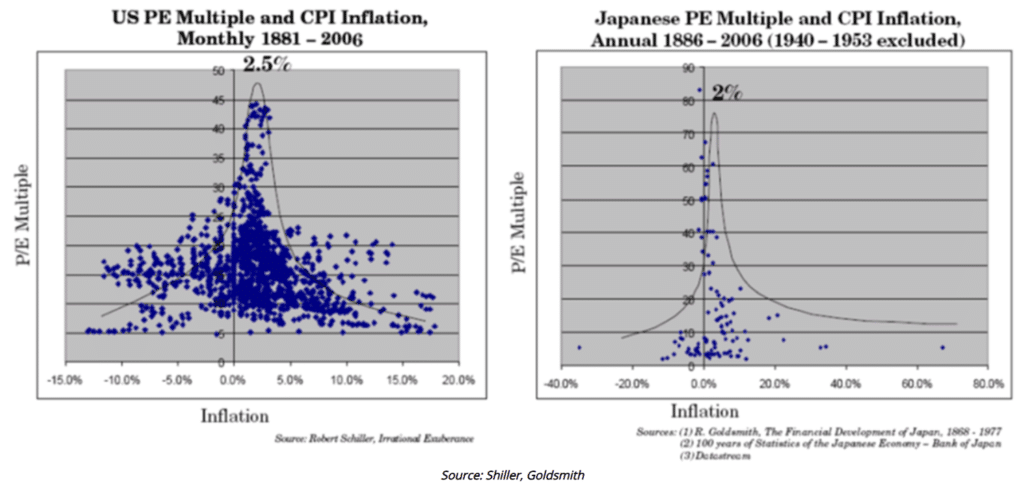

-> Inflation at its natural 2-3% level usually means streched multiple valuations on capital markets. Below please see 125-year P/E multiple statistics for US and Japan:

As you can see in times of inflation within 2-3% P/Es can extend even to 30-45x (in extreme cases in Japan it was even 60-70x). SP500 currently trades at 27x trailing P/E, 27x 2020 estimate and 21x 2021 estimate.

Summing up: One should expect continued chase for returns and higher valuations for longer. A perfect storm for a bubble? Possible. Time will tell.

Now let’s get on with the rebalancing of the GLP portfolio.

The rebalancing

The GLP ended August practically flat on month. Here are the main reasons:

-> Biggest negative contributor was TLT. The ETF dropped 5.2% on month. Its influence on the whole portfolio’s performance was -1.9%. This was mainly due to: (a) steeper yield curve (up to 0.66% from 0.45%) as markets keep shaking off the virus downturn, growth expectations slowly improve and inflation expectations edge higher after Fed’s message I described above (b) ongoing transition from safe haven assets (like US long-term treasuries) into riskier ones like stocks.

-> GLD was close to flat on month (-30bps) as it keeps consolidating above the all-time highs Gold bullion broke in July this year. GLD’s impact on the portfolio this month was -0.1%.

-> Equities as a whole added nicely, led by names like NVDA (+26%), SQ (+23%), AMD (+17%) and FB (+16%). On aggregate equities added +2% this month.

This month we’re marginally cutting the equities weight to adjust it back to 20% from 21.5% as of end of August. Selling the following: 10% of NVDA, 15% of SWKS, 23% of FB and 21% of SQ. Proceeds go into GLD. Gold broke all-time highs and with Fed’s message I expect to see further upside. Also, as inflation expectations are expected to be dragged up higher and the yield curve to steepen, I expect TLT returns to moderate vs. 1H20.

Portfolio holdings are traded at the closing price on the rebalancing day presented by www.morningstar.com (which may differ from official closing prices given by appropriate stock exchanges).

Current structure of the GLP can be found on Portfolios page.

Total Personal Return since inception (TPR) of GLP as of close 31st August 2020: +17.5%.

Next update in a month.

Yours,

PC

Disclaimers: None of the ideas, views and thoughts presented here shall ever be taken as a recommendation to buy or sell stocks,bonds,FX,commodities or any other financial instruments as stated in REGULATION (EU) No 596/2014 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC or the Regulation of the Polish Minister of Finance of 19 October 2005 on information constituting recommendations regarding financial instruments, their issuers or exhibitors (Journal of Laws of 2005, No. 206, item 1715) or the Polish Act of 10 February 2017 amending the act on trading in financial instruments and some other acts. The article is for educational reasons and purely presents private views of the author, thus the author shall not be claimed eligibile for any losses of a third party resulting from trading activities based upon this article. The author uses his best knowledge and data from sources believed to be reliable, but makes no representations as to the accuracy of the data.Full Disclaimers&Liability Limitations page.