Dear Followers&Copiers, In this post I run a fundamental update for $AAPL, which “designs, manufactures and markets mobile communication and media devices, personal computers and portable digital music players. The Company sells a range of related software, services, accessories, networking solutions, and third-party digital content and applications. The Company’s segments include the Americas, Europe, Greater China, Japan and Rest of Asia Pacific. The Americas segment includes both North and South America. The Europe segment includes European countries, India, the Middle East and Africa. The Greater China segment includes China, Hong Kong and Taiwan. The Rest of Asia Pacific segment includes Australia and the Asian countries not included in the Company’s other operating segments. Its products and services include iPhone, iPad, Mac, iPod, Apple Watch, Apple TV, a portfolio of consumer and professional software applications, iPhone OS (iOS), OS X and watchOS operating systems, iCloud, Apple Pay and a range of accessory, service and support offerings.” (CNBC)

Another Financial Year (FY) has passed and it’s time to update the equity portfolio of the Global Leaders Portfolio (GLP) in terms of the SIAScore we use. $AAPL is one of our portfolio names. Let’s quickly remind what SIAScore is and how the process :

S1: growing sector 1pts/0pts,

S2: incumbent or prospective global leader 1pts/0pts,

S3: growing or stable wide margins (40%+ gross; 3yr avg) 2pts/0pts,

S4: Net Debt/EBITDA <1.5 (last 3 ended FYs) 2pts/0pts,

S5: above-average cash flows (FCF/MktCap (last 3 ended FYs) > S&P500 Dividend Yield or US 10yr Treasry Yield (higher of the values)) 2pts/0pts;

MAX TOTAL SCORE: 8pts/MIN TOTAL SCORE: 0pts/MIN SCORE TO QUALIFY: 4pts

Let’s analyse each step now…

S1: 1 point

$AAPL operates in a growing sector of digital software and hardware production. It also develops into new sectors like semiconductors, cloud computing and payment systems.

S2: 1 points

The company is among the leaders in its sector. It has a very strong brand and great number of very loyal supporters and clients.

S3: 1 point

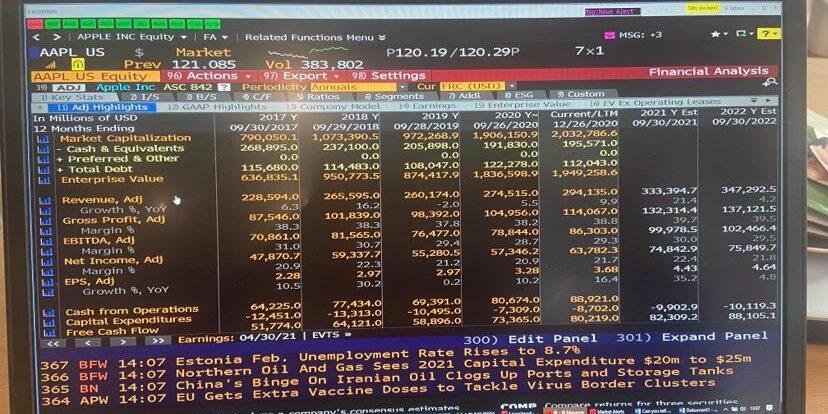

2018——2019——-2020——-AVG——-last yr AVG

38,3%….. 37,8%…….38,2%…….38,1%…….38,1%

Gross Profit Margin (GPM) is below, but just below our minimal required level of 40$ and shows no signs of deterioration. Hence $AAPL gets 1pt here. Going forward, a susbtantial decrease of GPM might be one of the 1st signs that the $AAPL growth story subsides. this is not the case just yet.

S4: 2 points

2018——2019——-2020——-AVG——-last yr AVG

-1,5……….-1,28……….-0,85………-1,21………..-1,65

$AAPL‘s net cash position is very safe, but the 3yr avg deteriorated somewhat form last year. Not a sign for worries, given the company’s liquidity levels.

S5: 2 points

2018——2019——-2020——-AVG——-last yr AVG

6,0%……….6,1%……….3,8%……….5,3%……….6,2%

The avg 3yr FCF yield is above the minimum treshold level, which is currently at higher of the two: the $SPX500 dividend yield (1,53%) and the 10Y treasury note yield (1,7%). Hence the stock is a good alternative to other stocks, as well as to the risk-free assets, even after such a big move higher in the yields lately.

Aggregate for $AAPL: 7 points (stable YoY).

Conclusion: Fundamentals of $AAPL sound. GPM must b watched. Valuation-wise it trades at 35,6x TTM PE, with the avg for the $SPX500 Shiller CAPE at similat level of 36,6x. Additionally its 1yr forward PE stands at 27,8x, which is acceptable on relative basis, but not cheapest. Technically the stock is appx 10% off its ATH around USD145, so u/ped peers lately. Avg analyst’s 12-month target price for the stock is USD154,35. I keep $AAPL in my portfolio as long-term holding.

Best regards, GlobalAlphaS

Disclaimers: None of the ideas, views and thoughts presented here shall ever be taken as a recommendation to buy or sell stocks,bonds,FX,commodities or any other financial instruments as stated in REGULATION (EU) No 596/2014 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC or the Polish Act of 10 February 2017 amending the act on trading in financial instruments and some other acts. The article is for educational reasons and purely presents private views of the author, thus the author shall not be held accountable for any losses of a third party resulting from any potential trading activities in any instruments, both specifically or by category of assets. The author uses his best knowledge and data from sources believed to be reliable, but makes no representations as to the accuracy of the data.Full Disclaimers&Liability Limitations page.