Greetings from the Netherlands dear Smart Investors! I strongly recommend visiting this beautiful flat-like-a-table country to anyone who likes active holidays. Biking routes are plenty everywhere and the Dutch plains are so easy for the kids to bike! You really feel save eveywhere you go with your bike, as bikers have top priority here :). OK onto the markets:

Last week

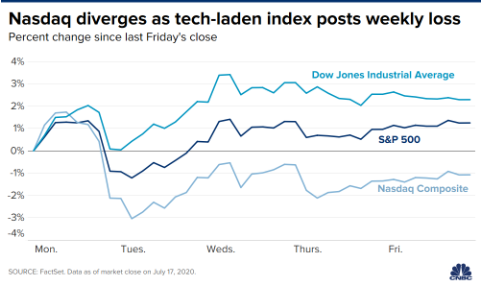

-> Two major things happened on Monday: 1st the SP500 briefly turned positive for they year intraday to pull back later in the session as California annouced closure of some indoor bisinesses, 2nd Tesla (TSLA) became US 10th biggest stock by market cap. TSLA jumped 12% in the morning just to give up al the gains later and turn negative. This spurred a wider technology led sell-off. All the tech bluechips, Netflix (NFLX), Microsoft (MSFT) , Amazon (AMZN), and Facebook (FB) showed considerable weakness.

-> The high-tech underperformance persisted until the end of week. Some market observers explained it with a rotation back into some of the old economy names, which surprised with 2Q20 numbers. The list of positive numbers surprises include JPMorgan Chase (JPM) on the back of a massive surge in trading revenue, Citigroup (C) also driven in part by a sharp uptick in trading revenue, and last but not least Goldman Sachs (GS), which showed a blow-out report with a Net Profit of $6.26 a share, far beyond the $3.78 a share estimate.

-> Additionally usual Dow Jones Industrial Average heavy-weight cyclicals performed very nice this week. Names like Caterpillar (CAT), Exxon Mobil (XOM) and Chevron (CVX) or Boeing (BA) all traded up on the week nicely, as there’s more and more talk on the street the Covid-related Nasdaq outperformance is due for at least a pause.

-> On the political front the US presidential campaign started heating up. Freshest polls showed that the democratic candidate Joe Biden leads over the incumbent president Donald Trump in most of the swing states like Arizona, Florida, Michigan, Pennsylvania and Wisconsin.

-> On Thursday Netflix (NFLX) added to the general dismal high-tech picture with disappointing results (EPS $1.59 vs.$1.81 expected) and provided weak subscriber growth guidance for the third quarter.

-> Effective weekly index changes: S&P500 +1.3%, Nasdaq -1.1%, EuroStoxx600 +1.6%, DAX +2.3%, Nikkei225 +1.8%.

Other markets events:

-> Bonds: US yield curve (10y-FF) stable around 0.54%, German curve (10Y Bunds-3M) unchanged 0.11% with 10Y Bunds at -0.46%, High Yield Spreads at 5.7.

-> Commodities (ex oil): Gold added 60bps and closed the week slightly above the $1800/ounce level.

-> Oil: flat for the week.

-> Currencies: Dollar weakened again this week with DXY (Dollar Index) -0.7%, EURUSD +1.1%.

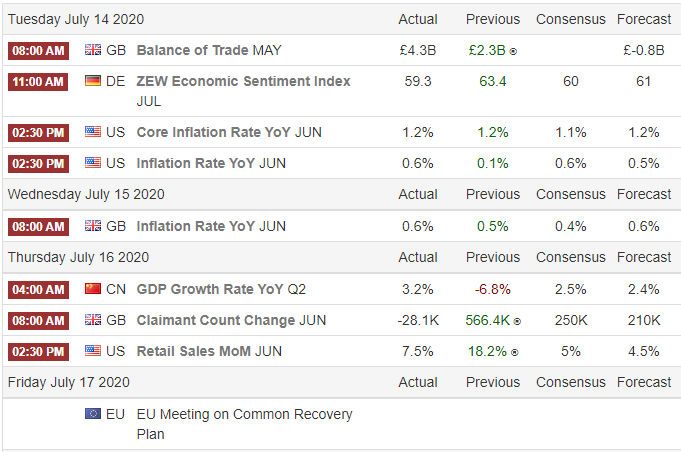

Major macro events: (times are CET):

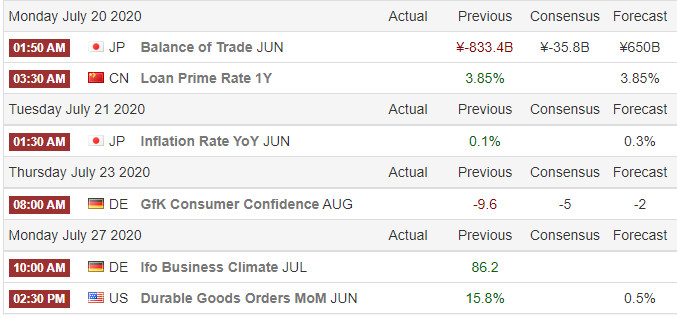

Next Week’s major macro events:

Yours!

PC

Disclaimers: None of the ideas, views and thoughts presented here shall ever be taken as a recommendation to buy or sell stocks,bonds,FX,commodities or any other financial instruments as stated in REGULATION (EU) No 596/2014 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC or the Regulation of the Polish Minister of Finance of 19 October 2005 on information constituting recommendations regarding financial instruments, their issuers or exhibitors (Journal of Laws of 2005, No. 206, item 1715) or the Polish Act of 10 February 2017 amending the act on trading in financial instruments and some other acts. The article is for educational reasons and purely presents private views of the author, thus the author shall not be claimed eligibile for any losses of a third party resulting from trading activities based upon this article. The author uses his best knowledge and data from sources believed to be reliable, but makes no representations as to the accuracy of the data.Full Disclaimers&Liability Limitations