Table of Contents

This week was Thanksgiving week for US markets. Activity was somewhat subdue because of that around mid-week. But in general equities did just well, unlike safe havens like Gold. The risk is on.

After last’ weeks consolidation at or just above all-time highs for the equities, this week indices started marching higher. Old economy stocks were among leading sectors, utility commodities did well and so did oil. the big revival trade is on across the board. This trend naturally puts pressure on safe havens and value holders. That’s why precious metals like Gold and Silver were down on week quite substantially. Please bear in mind such moves are an effect of rotation into riskier assets. In the longer run the big trade of inflation revival is still in place, as inflation expectations are already marching higher. This is expressed by continously steepening yield curve in recent weeks. Let’s get onto the details of the week behind us shortly…

Last week

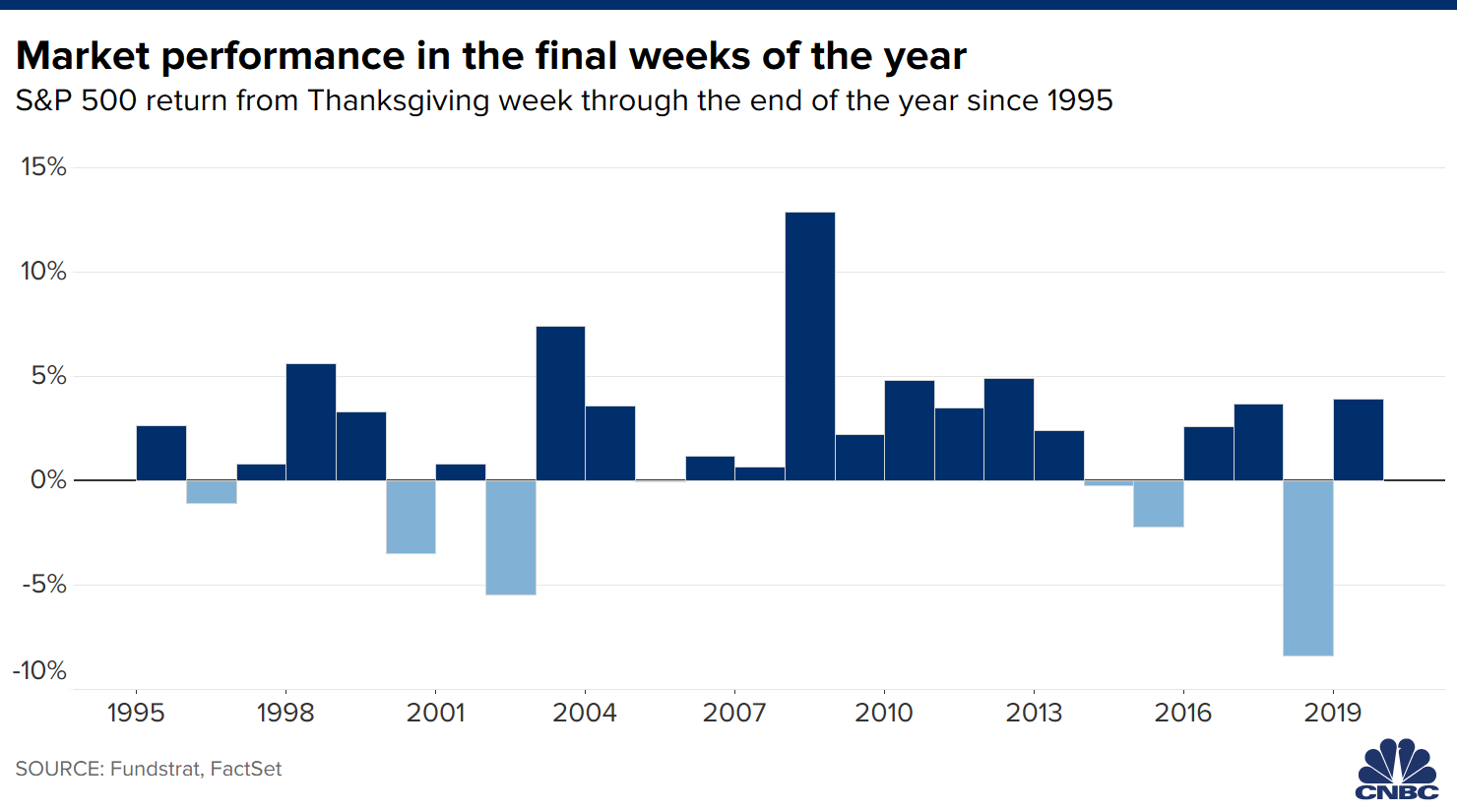

-> Monday kicked off in a typical Thanksgiving-week manner, which is strong. A broader typical pattern of stronget equities into the last weeks of year is possibly starting to play out this year as well. Here’s some data form CNBC on that matter:

-> The Monday move was fueled by another positive newsflow on coronavirus vaccine. This time AstraZeneca (AZN) and Universityof Oxford announced over 90% eficacy of the drug they work on.

-> Additionally investors got some good news on the macro front. Namely, President elect Joe Biden announced that he plans to nominate Janet Yellen as his Treasury Secretary. Ms. Yellen is a good old friend of Wall Street from the times of her tenure as Fed Chair (2014-18). Markets took it as a positive sign of the new administration to be possibly able to aviod double-dip recession with her in place .

-> The Covid-hit sectors led the gains broadly: Airlines, Cruisers in front. Hi-Tech underperformed (of course).

-> Tuesday brought a big psychological event – the round 30 000 pts treshold was broken by the Dow Jones Industrial Avergade (Dow), which was naturally cheered by the market participants. Also Russell 2000 (RTY) (the mid-cap index) performed very well again last week, after it broke to new highs the week before (I wrote about it here).

-> Pretty quiet, slighly corrective session on Wednesday followed.

-> Thursday – Thanksgiving. US markets closed and rest of the world trading in a subdue mode.

-> On Friday markets were open short hours. Optimism form previous day persisted and indices ended the week around the highs.

-> What needs to be noted this week is the strenght of Asian markets. Nikkei225 outperformed all other major indices.

-> Effective weekly index changes: S&P500 +1.6%, Nasdaq +2.5%, EuroStoxx600 +0.9%, DAX +1.5%, Nikkei225 +4.4%.

Other markets events:

-> Bonds: the US yield curve (10y-FF) stays around 80bps, the German curve (10Y Bunds-3M) at 12bps with 10Y Bunds at -0.58%. High Yield Spreads keep staying low at aroud 4.5.

-> Commodities (ex oil): value holding and safe haven commodities underperformed this wek again. Gold down over 4% on week, Silver down over 6%. Utitlity metals like Copper on the other hand did just fine (up almost 4%). The economy revival trade in front of our eyes…

-> Oil: …also seen in the performance of Oil, which is up 7% this week and almost 30% this month.

-> Currencies: DXY (Dollar Index) not that much action on the currency front with DXY -0.6% on week, EURUSD +0.8%.

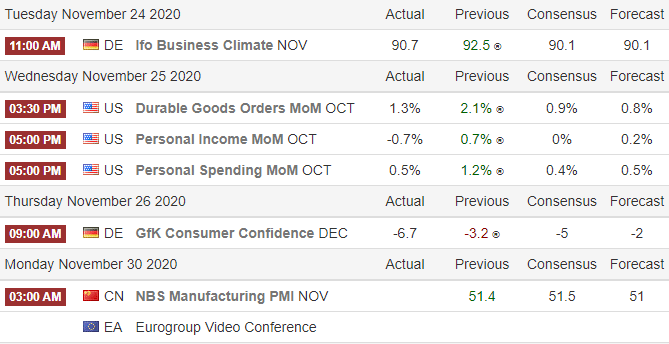

Major macro events: (times are CET; source: tradingeconomics.com):

Next Week’s major macro events:

Yours!

PC

Disclaimers: None of the ideas, views and thoughts presented here shall ever be taken as a recommendation to buy or sell stocks,bonds,FX,commodities or any other financial instruments as stated in REGULATION (EU) No 596/2014 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC or the Polish Act of 10 February 2017 amending the act on trading in financial instruments and some other acts. The article is for educational reasons and purely presents private views of the author, thus the author shall not be held accountable for any losses of a third party resulting from any potential trading activities in any instruments, both specifically or by category of assets. The author uses his best knowledge and data from sources believed to be reliable, but makes no representations as to the accuracy of the data.Full Disclaimers&Liability Limitations page.