It was a shorter week last week due to a day off on Friday to celebrate the Independence Day in the USA. Here’s what was up in short:

Last week

-> The markets last week were slowly getting used to the rising virus cases and the marginal negtive effect of such news on the equity indices was smaller every day.

-> Markets were still supported by constant injections of liquidity. It can be clearly seen by continuous rise in the ECB’s balance sheet for instance, which the week before alone grew by as much as 11%. This hugely improves liquidity in capital markets and definitely supports riskier assets like equities. I wrote about it here.

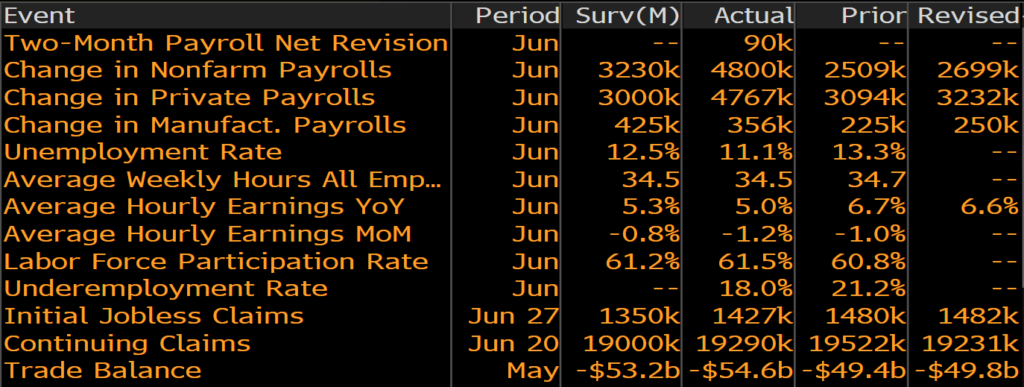

-> Thursday’s jobs data was the cherry on the cake last week. In June US labour market suprised to the upside again and the change in Nonfarm Payrolls was much above expectations (see below from Bloomberg):

-> On Friday the US markets were closed for Independence Day.

-> Effective weekly index changes: S&P500 +1.5%, Nasdaq +1.9%, EuroStoxx600 +1.9%, DAX -2.0%, Nikkei225 -0.9%.

Other markets events:

-> Bonds: US yield curve (10y-FF) was stable around 0.6% again, German curve (10Y Bunds-3M) ended 0.11% with 10Y Bunds at -0.43%, High Yield Spreads at 6.1% – not much action.

-> Commodities (ex oil): Gold ended +0.1% just under $1800/ounce psychological level, where it consolidated whole week.

-> Oil: +4.2% on week

-> Currencies: not much aciton in currencies, DXY (Dollar Index) -0.24%, EURUSD +0.2%.

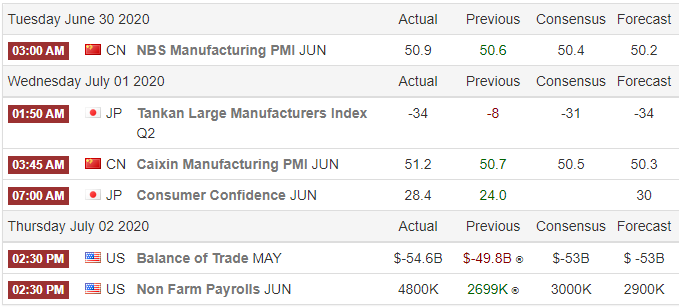

Major macro events: (times are CET):

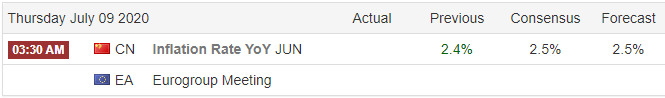

Next Week’s major macro events:

Yours!

PC

Disclaimers: None of the ideas, views and thoughts presented here shall ever be taken as a recommendation to buy or sell stocks,bonds,FX,commodities or any other financial instruments as stated in REGULATION (EU) No 596/2014 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC or the Regulation of the Polish Minister of Finance of 19 October 2005 on information constituting recommendations regarding financial instruments, their issuers or exhibitors (Journal of Laws of 2005, No. 206, item 1715) or the Polish Act of 10 February 2017 amending the act on trading in financial instruments and some other acts. The article is for educational reasons and purely presents private views of the author, thus the author shall not be claimed eligibile for any losses of a third party resulting from trading activities based upon this article. The author uses his best knowledge and data from sources believed to be reliable, but makes no representations as to the accuracy of the data.Full Disclaimers&Liability Limitations page.Categories: Investing, News&TrendsCategories: Investing, Macro, News&Trends