Last week was pretty interesting actually, even though we’re in the middle of the summer season. There has been little macro data, hence the market concentrated more on stock-specific situations. Let’s take a look:

Last week

-> Global markets rallied on Monday to start the week, boosted, amongst others, by the Chinese government telling people to “prepare for a healthy bull market”. Covid-19 cases were not on the agenda since a while now. In the US gains were led by Amazon (AMZN) crossing a round $3000/shre level and making new all-time highs. Other high-tech bluechips like Microsotf (MSFT) and Google (GOOG) also climbed. Buffett’s Berkshire Hathaway (BRK/B) announced a $10bn deal to buy nat gas assets of Dominion Energy.

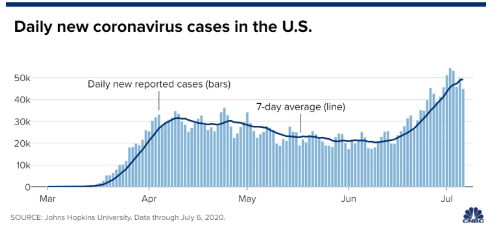

-> Tuesday put a pause to the rally as 3 US states have paused reopening due to the new cases spike. OK, let’s show a Covid-19 case graph here. that’s how it look as of now in US:

source: cnbc.com

-> The wobbling continued up until Thursday.

-> Tech shares again substantially outperformed and Nasdaq kept making new highs, while SP500 and Dow struggled for any gains. This was mostly seen on Thursday.

-> Equities resumed the rally on Friday to end the week at highs.

-> SP500 formed a so called Golden Cross on Friday (50 moving avergage up through 200 moving average), which technicians read as a bullish sign. “Recession Golden Crosses indicate an improving equity market during periods of economic stress,” Stephen Suttmeier, Bank of America’s chief equity technical strategist said.

-> Effective weekly index changes: S&P500 +1.8%, Nasdaq +4%, EuroStoxx600 +0.4%, DAX -0.8%, Nikkei225 +0.0%.

Other markets events:

-> Bonds: US yield curve (10y-FF) flattened to 0.53% on virus woes, German curve (10Y Bunds-3M) was mostly unchanged 0.10% with 10Y Bunds at -0.46%, High Yield Spreads at 6% – not much action.

-> Commodities (ex oil): Gold added 80bps as it still flirts with the $1800/ounce lvl

-> Oil: +1% on week with not much volatility

-> Currencies: Dollar weakened a bit this week with DXY (Dollar Index) -0.5%, EURUSD +0.4%.

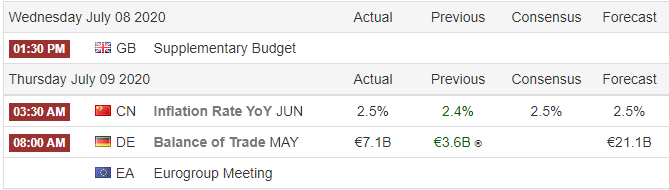

Major macro events: (times are CET):

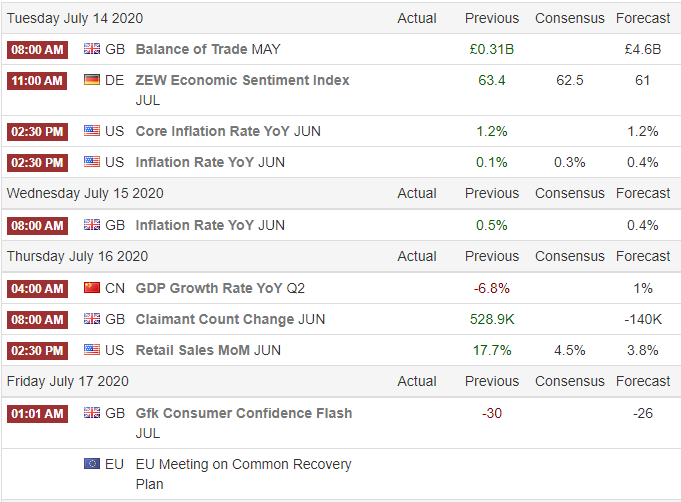

Next Week’s major macro events:

Yours!

PC

Disclaimers: None of the ideas, views and thoughts presented here shall ever be taken as a recommendation to buy or sell stocks,bonds,FX,commodities or any other financial instruments as stated in REGULATION (EU) No 596/2014 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC or the Regulation of the Polish Minister of Finance of 19 October 2005 on information constituting recommendations regarding financial instruments, their issuers or exhibitors (Journal of Laws of 2005, No. 206, item 1715) or the Polish Act of 10 February 2017 amending the act on trading in financial instruments and some other acts. The article is for educational reasons and purely presents private views of the author, thus the author shall not be claimed eligibile for any losses of a third party resulting from trading activities based upon this article. The author uses his best knowledge and data from sources believed to be reliable, but makes no representations as to the accuracy of the data.Full Disclaimers&Liability Limitations page.Categories: Investing, News&TrendsCategories: Investing, Macro, News&Trends