It is an extremely important thing to understand that every kind of investment carries certain amount of risk. Returns are as a rule a function of risk. Before starting to build an own portfolio of financial instruments everyone should first test their knowledge about financial instuments, their characteristics and the risks they carry. It is also important to make a fair assessment of personal risk acceptance level and adjust the exposure to financial instruments appropriately. In real life you will now ever buy a new cauch or a fridge without checking all the possible details about it first, will you? It should be the same with financial instruments.

Risk is everywhere

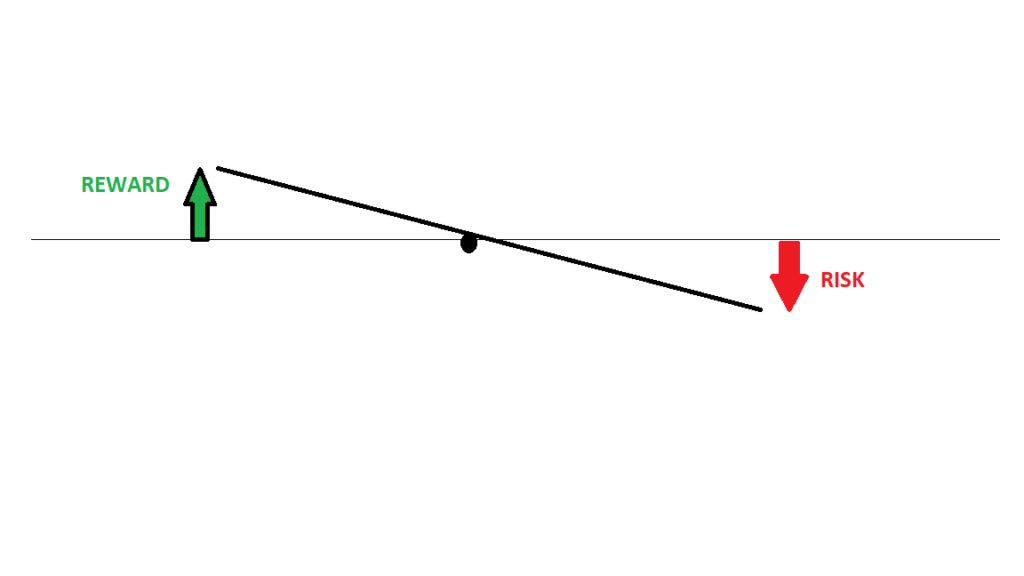

Risk is a word most connotate with a negative outcome (or loss) on an undertaking that is unprobable, but with a possibility of happening higher than zero. Majority of people do not understand though that risk can actually mean a gain as well. What we call “risky” assets (like stocks, derivatives, etc) are called like this for a reason. That’s because their so called “expected returns” are on average higher than on other assets, which are less “risky”. So “risk” and “expected return” is really two ends of the same stick. Risk is the acceptance of higher probability of a negative outcome while also getting a higher chance of a better return on an undertaking one plans. As you see it’s like this stick that swings one way or another:

Or said differently: to take on a riskier undertaking one demands a higher reward (expected return). These rules exist in every activity in the world we live in. Human beings always try to balance between potential risk and reward and try to measure (conciously or subconciously) the level of risk in every undertaking. At least the risk that can be measured and is within our control. There’s also another kind of risk as well – the one you cannot control or predict. Being a 65 year old overweight person and going our for a walk with your dog you’re taking smaller risk than going running a marathon or doing one hour intensive taba exercises. Your return is better health, your asset at stake is your heart and your life. Or else, a responsible father of 3 kids will rather not engage in skydiving or some other extreme sports, untill he’s sure his kids are gown up and can earn their own living. His expected return is the wellbeing of his beloved children and his risk is him dying and leaving them alone without a father. When you buy a new car you also always look for a perfect match between price and quality. Quality is your reward and price (if too high compared to quality) is your risk. People always choose between risk and reward (or return). Risk is everywhere…

Risk in investing

Similar rules apply to the world of finance and financial instruments. Here risk is generally defined as “the change that an outcome or investment’s actual gains will differ from an expected outcome or return” (source: investopedia.com). There’s quite a bit of different types of risk in finance:

(a) market risk :

-> equity risk: in short term it’s the risk of the stock prices fall (or rise) – measured by implied (expected) volatility; in the long term it’s the risk of equites providing better returns than the risk-free rate – measured by equity risk premium;

-> interest rate risk: the change that market interest rates rise or fall – the can can tons of different implications for all possible types of financial assets and their valuations; as a rule higher interest rates discourage riskier assets over less risky ones by making them less attractive on risk/reward basis and by making the price of money higher for riskier assets to be financed;

-> currency risk: the risk that FX rates or implied volatility changes making the eventual return on FX-denominated investments different from the expectations of an investor; FX impacts the final reuturn in different ways – through direct impact on the investor’s exposure on an investment and via impact of FX rates on the businesses the investor’s holding (meaning equity here) runs (this is especially the case of multinational corporations, but also smaller firms doing imports/exports as part of their everyday operations);

-> commodity risk: the risk of commodity prices impacting businesses purchases and sales change;

(b) model risk: the risk of the model applied to value an investment is wrong; that happens very often, given practically all valuations in the financial world are based on some kind of models and assumptions;

(c) credit risk: the possibility of a loan or debt (bond,note, etc) not being repaid in full or at all; this kind of risk is generally imporant to banks and debt provides to evaluate the debt issuer’s creditworthiness and the possibility of a default; indirectly this risk has major impact on equity investors as well, as a default first wipes out the company’s equity and only then its other stakeholders (debt holders, bank claims, contractor liabilities, etc);

(d) liquidity risk: this can be understood in two ways – as risk of not being able to get out of an investment without impacting its price or as risk of liabilities not being met when they are due (usually the case of companies falling in troubles and defaulting;

(e) other risks: legal, IT, reputation, etc.

And there’s also the so called systemic risk, so a risk that the whole financial system goes defunct due to a collapse of one institution that can be called “systemically important” (or “too big to fail”). Last but not least there’s also the inherent systematic risk of the whole system that is, unlike most other risks, undiversifiable, unpredictable and unavoidable.

The basic measure of risk in finance is the standard deviation (which statistically is the square root of variance). It is generally a measure telling us what the probability is of an investment return falling away from the expectation based on the level of risk it carries. A low standard deviation tells us that historically the dispersion of returns on an asset was close to the expected value (mean), whilst high standard deviation means the actual outcomes very often fall far away from what the expected return (or mean) on an asset is. The use of this measure was popularised yet in 1950’s by H.Markowitz, who developed the so called Modern Portfolio Theory (MPT). What’s clue to understand about standard deviation is shown in this example: 10-year Bond of a country A has an expected return of 5% and a standard deviation of 0,5%, whilst a stock B traded on the countty’s A stock exchange has an expected return of 10% and a standard deviation of 5% – this tells you that if you invest in the bond you can expect a lower return (5%) but also small swings of your investment throughout its lifetime (usually a deviation of more than 2x standard deviation from the mean is very seldom to occur), but if you chose to hold the stock B you will (in the long-run) most possibly reach higher returns (say 10% per year), but meanwhile your will see the price of your investment swing much more around the long term mean (you migh see years with a -tive reutrn of 5% or 10%, if 1x or 2x standard deviations from the mean (or long term expected returns) happen.

Time heals

With that in mind we’re coming to the next very important issue in investing -TIME. Time is absolutely crutial to understand as a crutial factor in investing. As you see above higher risk for an instument means higher short-term swings around the long-term expected returns. If an investor looks at this with a short-term prespective, he will put himself at risk of losing nerves at the worst possible moment (when a an asset is for instance 2x standard deviations down from its mean) and sell out on a short-term dip. And here comes time as the saviour. If your perspective is long-term, your attitude to the investment needs ot be long-term too! If you’re planning a 1-year investment, you probably do not want ot buy stocks (unless you just want to speculate), but if you are planning a portfolio for your pension and you’re 25 yrs only, stocks will possibly be the best choice for you. Adjusting time horizon to the level of risk is possibly one of the most important things any investor needs to understand before starting. The shorter time you have, the less risk you want to take. The longer the time available, the more risky undertakings you can get involved in. Same in finance, same in real life right? In finding the balance between risk and reward there’s also a few other instuments the financial world has to offer and that everyone should consider…

Diversification

Diversification is a risk management strategy aimed at smoothing out long-term returns on a portfolio by grabbing exposure to a wider range of assets, which are not ideally correlated (or non- or even negatively correlated). Diversification helps decrease the unnecessary unsystematic risk relatively to an investors risk profile. It can be done within asset classes (different stocks like cyclicals, defensives, growth stocks or distressed, etc – each of these types of stocks have different characteristics and behave differently dependant on market conditions), between assets classes (stocks, bonds, real estate, commodities, cash or equivalents) or by geography (by investing in different parts of the world also in different currencies).

Good diversificaiton of course comes at the cost of lower potential profits, but also lower potential losses. And that is the clue of it. Most authors and researchers wirting about diversification do agree that a too diversified portfolio is no good as well, mainly for two reasons: (a) at a certain level of diversification, every marginal asset brought to a portfolio is bringing smaller marginal benefits only (b) the efficiency of a portfolio manager (especially a single person like retail investors without institutional backup of analysts,etc.) is falling exponentially after a certain amount of assets in the portfolio. Most specialists agree that a portfolio of 20-30 assets (especially in case of riskiest ones like stocks) is usually optimally diversified.

Hedging

Just as diversification, hedging is a useful instrument that can protect a portfolio of assets in uncertain times. The problem with typical hedging strategies is though that they very often involve derivative instruments, which demand (a) professional knowledge about their implementation and carry (b) are based on margin accounts (c) have limited use to someone with limited funding possibilites as most retail investors do. I write a bit wider about this topic in my explanation of my Smart Investing approach (SIA) here. The bottom line is that typical hedging strategies should really be used by institutional investors only (maybe with the exception of buying options and using ETFs, but here also a bigger knowledge and experience is necessary to manage pricing and other peculiarities of these intruments). In my view, a retail investor with no sufficient knowledge and experience will be better off with good diversification (like balancing a portfolio of equities with other safer assets with no or negative correlation to stocks like bonds and gold, etc.).

Honest self-check

As you see above there’s quite a bit of things to worry about while being an investor. Unfortunatelly most people are not aware of the risks or ignore them deliberately. Their strong belief of having the right view at the right time, is usually tested hard buy the so called Market. In common use the word “market” is the place when people exchange their assets (stock exchanges, Over-The-Counter trading platforms, dark pools or any other venues). The more important meaning of “market” really, in my view, is the psyhological one. A market in that sense is the aggregate crowd mind of all the market’s participants. It is very mighty, it prices in the unknown and it usually makes widows of anyone, who plays against it. It is also very mean and vicious to the ones that do not obey. It swings and keeps every single participant in stress. The clue is to be able to manage the stress and not get involved into situations that are beyond somone’s acceptable stress and engagement levles.

To manage this I think that everyone should really honestly ask himself as to what he really wants, where he is in life, what the purpose of buying or selling certain assets is and what is his level of knowledge and understanding of the undertaking he takes upon. In recent years the market regulators have made a lot of efforts in helping non-institutional investors be more protected in their activities on financial markets. Possibly the most imporat part of all the regulations introduced lately, especially in the EU (but other biggest markets also to some extent followed suit), is the obligatory profiling of retail investors by investement firms (brokers, banks, asset managers, etc). Its purpose is to offer the clients only suitable financial instruments, which are neither too risky nor too complicated to somone’s experience, knowledge and attitude to risk. This profiling also given a backstop to any potential unjustified claims form unhappy clients, if they lose money of course. Every stick has two ends. But, for a person serious about what he buys into, profiling should be like a book about how to deal with electricity: “if you don’t know that this cable is for, don’t touch it, or you might get electrocuted! And it will be noone else’s fault but yours”.

So, I really genuinely suggest that any one of you readers of this post starting his or her journey in investing or saving starts with doing a proper and honest self-profing. You can most possibly do it with any of your bankers or brokers, but your can also find such on the internet. Possibly the best profiling is done in EU now, as under the regulations imposed by MIFID II (DIRECTIVE 2014/65/EU OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU). General guidelines and directives on how such questionnaires should look like and what they should aim at are laid out on the European Securities and Markets Authority (ESMA) website here and here. As you see such a questionnaire is supposed to provide a widest possible set of information about the client (and to the client himself as he answers all those questions) including: net worth situation, understanding of risk, suitability of certain products, the relationship between risk and return on investments and many many other imporatnt qthings like “marital status (especially the client’s legal capacity to commit assets that may belong also to his partner), family situation (changes in the family situation of a client may impact his financial situation e.g. a new child or a child of an age to start university), age (which is mostly important to ensure a correct assessment of the investment objectives, and in particular the level of financial risk that the investor is willing to take, as well as the holding period/investment horizon, which indicates the willingness to hold an investment for a certain period of time), employment situation (the degree of job security or that fact the client is close to retirement may impact his financial situation or his investment objectives), need for liquidity in certain relevant investments or need to fund a future financial commitment (e.g. property purchase, education fees)” (source: ESMA).

On top of making the investors more aware of the risks, profiling also looks to protect them from unfair practices by investment firms and make them aware of any possible: risks, costs, characteristics of the proposed financial instruments, existing or potential conflicts of interest, methods of custody or methods of executing orders.

You can find some pretty good examples of such questionnaires here, here or here. Or just ask your broker to get you one. Only after filling such a form can anyone be really aware of what’s good from him and what’s not.

Once you have gone though all the above, you might want to continue developing in the area of investing. I suggest you take a look at my posts building a base of what I call Smart Investing Approach (SIA), SIA-style portolfios here and here.

Stay safe!

PC

Disclaimers: None of the ideas, views and thoughts presented here shall ever be taken as a recommendation to buy or sell stocks,bonds,FX,commodities or any other financial instruments as stated in REGULATION (EU) No 596/2014 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC or the Regulation of the Polish Minister of Finance of 19 October 2005 on information constituting recommendations regarding financial instruments, their issuers or exhibitors (Journal of Laws of 2005, No. 206, item 1715) or the Polish Act of 10 February 2017 amending the act on trading in financial instruments and some other acts. The article is for educational reasons and purely presents private views of the author, thus the author shall not be claimed eligibile for any losses of a third party resulting from trading activities based upon this article. The author uses his best knowledge and data from sources believed to be reliable, but makes no representations as to the accuracy of the data. Full Disclaimers&Liability Limitations page.