Table of Contents

The market has mostly consolidated at around its all-time highs this week. The range was narrow. The SP500 traded within 100 pts and Nasdaq within less than 300 pts. Boring you think? Not quite. Let’s see what was up.

According to more and more signs the equities markets keep discounting a cycle phase change. A few new little steps towards recovery happened this week. All of this year’s major risk events (at least these of which market knew) are behind us now. The path of improvement due in the labour market seems to be the ultimate determinant of when and how the cycle phase change will happen.

Last week

-> Monday saw some gains on the news about Moderna (MRNA) being the second US pharma company to announce that their preliminary trials of its Covid-10 vaccine had an effectiveness as high as 94%. The reaction was naturally more muted than the one similar news from Pfizer (PFE) a few days back. Meanwhile the virus cases have been making another surge. The SP500 gained 1.2% and made new highs.

-> On Tuesday Fed Chair J.Powell had a speech at the Business Hall of Fame Awards Academy. I haven’t found anything new or interesting from him that day. Tesla (TSLA) skyrocketed more than 13% as it was finally announced it will officially be included in the SP500 index. The rummors and expectations for that to happen have been around for a few quarters already. That’s why it suffered by the last announcement a quarter ago, as it failed to be added back then.

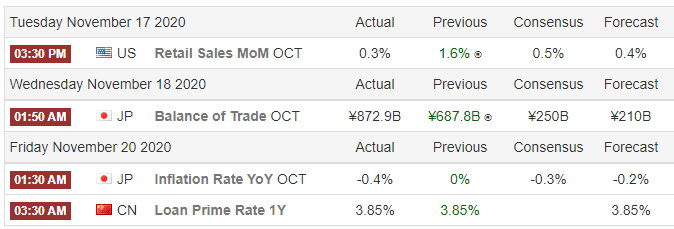

-> On the macro front October Retail Sales surprised to the downside on Tuesday with a +0.3% MoM read vs. +0.5% expected.

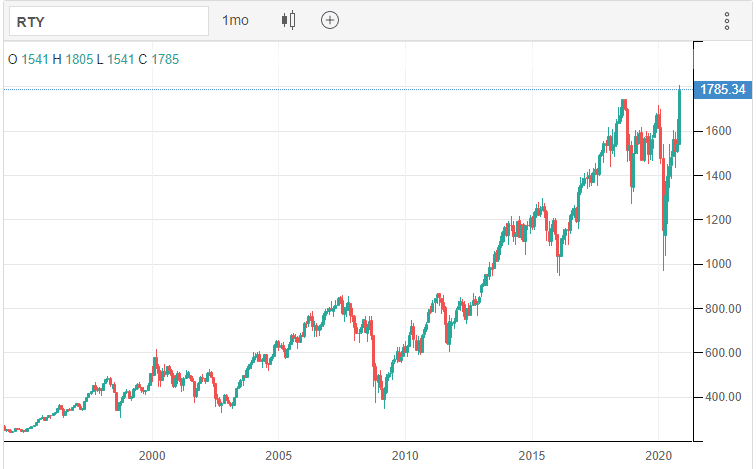

-> One of the major things to notice this week was the fact that the small-cap index Russell 2000 (RTY) finally managed to join the rest of the benchmarks in making all-time highs (see graph below). The fact that RTY managed to break last bull market’s highs is actually very bullish for all the equities. This index is much more cyclical than the other blue-chip indices. The move, accompanied by the good news from vaccine front, underscores the fact that the economy is paving its way to the Recovery phase. Once that happens and we have enough data to be sure we’re out of the recessionary woods, the Smart Investing Approach (SIA) portfolios will start undergoing a major long-term change in allocation structure. Bias will of course go much towards equities. Take a look at the allocation rules for the Global Leaders Potfolio (GLP) here, if you’d wish to refresh them.

-> On Wednesday Mr. de Blasio (NYC Mayor) announced the reestablishment of remote learning in schools. This put pressure on the market sentiment, but did not cause a big drop.

-> As the cases keep flying higher every day of late, Thrusday brought another swing towards high-tech names vs. old economy representatives. These swings seem to be more and more moderate now though. All in all the market seems to have mostly digested the rotation and the indices seem to be catching more correlation between one another. Bill Ackman though still expects a “tragic” end of the year.

-> Friday ended in the red as rising Covid cases overshadowed the positive mood caused by the earlier vaccine news. JP Morgan said it expects that the US economy will conract by 1% in 1Q21 due to renewed lockdown measures being implemented in some areas.

-> Effective weekly index changes: S&P500 -0.8%, Nasdaq +0.2%, EuroStoxx600 +1.2%, DAX +0.5%, Nikkei225 +0.6%.

Other markets events:

-> Bonds: the US yield curve (10y-FF) hovered around 80bps, the German curve (10Y Bunds-3M) at 12bps with 10Y Bunds at -0.58%. High Yield Spreads keep staying low at aroud 4.5.

-> Commodities (ex oil): value holding and safe haven commodities underperformed massively this week with Gold down 3.2% on week, Silver down 3.8% and Platinum flat on week.

-> Oil: stays strong again on revival hoped. added 5.8% this week.

-> Currencies: DXY (Dollar Index) -0.4% on week, EURUSD +0.2%.

Major macro events: (times are CET; source: tradingeconomics.com):

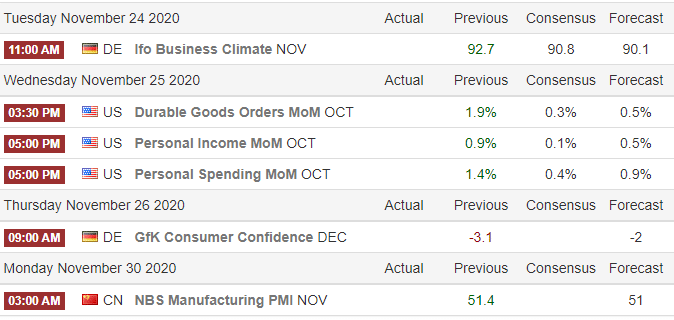

Next Week’s major macro events:

Yours!

PC

Disclaimers: None of the ideas, views and thoughts presented here shall ever be taken as a recommendation to buy or sell stocks,bonds,FX,commodities or any other financial instruments as stated in REGULATION (EU) No 596/2014 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC or the Polish Act of 10 February 2017 amending the act on trading in financial instruments and some other acts. The article is for educational reasons and purely presents private views of the author, thus the author shall not be held accountable for any losses of a third party resulting from any potential trading activities in any instruments, both specifically or by category of assets. The author uses his best knowledge and data from sources believed to be reliable, but makes no representations as to the accuracy of the data.Full Disclaimers&Liability Limitations page.