Table of Contents

𝘼 𝙨𝙡𝙞𝙜𝙝𝙩𝙡𝙮 𝙘𝙤𝙧𝙧𝙚𝙘𝙩𝙞𝙫𝙚 𝙬𝙚𝙚𝙠 𝙗𝙚𝙝𝙞𝙣𝙙 𝙪𝙨. 𝙏𝙝𝙚 𝙘𝙤𝙧𝙧𝙚𝙘𝙩𝙞𝙤𝙣 𝙬𝙖𝙨 𝙖𝙘𝙘𝙤𝙢𝙥𝙖𝙣𝙞𝙚𝙙 𝙬𝙞𝙩𝙝 𝙖 𝙡𝙞𝙩𝙩𝙡𝙚 𝙩𝙞𝙡𝙩 𝙩𝙤𝙬𝙖𝙧𝙙𝙨 𝙂𝙧𝙤𝙬𝙩𝙝 𝙛𝙧𝙤𝙢 𝙩𝙝𝙚 𝙧𝙚𝙘𝙚𝙣𝙩𝙡𝙮 𝙞𝙣-𝙫𝙤𝙜𝙪𝙚 𝙑𝙖𝙡𝙪𝙚 𝙨𝙩𝙤𝙘𝙠𝙨. 𝙁𝙞𝙨𝙘𝙖𝙡 𝙩𝙖𝙡𝙠𝙨 𝙨𝙚𝙚𝙢 𝙩𝙤 𝙗𝙚 𝙣𝙚𝙫𝙚𝙧 𝙚𝙣𝙙𝙞𝙣𝙜 𝙣𝙤𝙬 𝙖𝙣𝙙 𝙞𝙣𝙫𝙚𝙨𝙩𝙤𝙧𝙨 𝙨𝙩𝙞𝙡𝙡 𝙜𝙚𝙩 𝙣𝙤 𝙙𝙚𝙖𝙡 𝙤𝙣 𝙖 𝙣𝙚𝙬 𝙨𝙩𝙞𝙢𝙪𝙡𝙪𝙨. 𝘾𝙤𝙫𝙞𝙙-𝟭𝟵 𝙘𝙖𝙨𝙚𝙨 𝙖𝙧𝙚 𝙨𝙩𝙞𝙡𝙡 𝙤𝙣 𝙩𝙝𝙚 𝙧𝙞𝙨𝙚 𝙞𝙣 𝙜𝙚𝙣𝙚𝙧𝙖𝙡 𝙥𝙪𝙩𝙩𝙞𝙣𝙜 𝙥𝙧𝙚𝙨𝙨𝙪𝙧𝙚 𝙤𝙣 𝙨𝙝𝙤𝙧𝙩-𝙩𝙚𝙧𝙢 𝙤𝙥𝙩𝙞𝙢𝙞𝙨𝙢.

Equity indices took a breather this week after having eked out new all-time highs (ATH) in the previous week and intra-week ATH this Wednesday. $SPX500 slid 1% on week and so did other American as well as EU and JP stocks. The commodities front calmed down. Here’s what was up…

𝗟𝗮𝘀𝘁 𝘄𝗲𝗲𝗸

👉 On Monday a clear outperformance of Growth vs. Value was seen. Whilst $DJ30 dropped, Nasdaq was still up. Similar tendency was seen in the mid-cap space represented by iShares Russell 1000 Value ETF ($IWD) and the iShares Russell 1000 Growth ETF ($IWF).

👉 At the start of the week BlackRock made a bullish call for equities for 2021 seeing a “powerful restart of the economy”: www.cnbc.com/2020/12/07/blackrock-takes-equities-to-overweight-for-2021-sees-powerful-restart-to-the-economy.html?__source=newsletter%7Ceveningbrief

👉 On Tuesday UK started their vaccinations for Covid-19. Shares of $PFE (Pfizer) jumped 3%. The US approval of their vaccine is still due.

👉 On Wednesday 𝙐𝙆 𝙗𝙚𝙘𝙖𝙢𝙚 𝙩𝙝𝙚 𝟭𝙨𝙩 𝙘𝙤𝙪𝙣𝙩𝙧𝙮 𝙩𝙤 𝙖𝙥𝙥𝙧𝙤𝙫𝙚 𝙩𝙝𝙚 $𝙋𝙁𝙀 -𝘽𝙞𝙤𝙉𝙏𝙚𝙘𝙝 𝙫𝙖𝙘𝙘𝙞𝙣𝙚, pouring further optimism into the market. Indices closed at yet new highs on that day. Energy names poped higher as well ending up 1.5% on the day. Revival play stocks like $DD (DowDuPont Inc) , $JNJ (Johnson & Johnson) and $MMM (3M) also led the gains.

👉 Wednesday turned out corrective for the high-tech space mainly. Semiconductors, $AAPL (Apple) , $CRM (Salesforce.com Inc) , $FB (Facebook) were all down on day. Nasdaq slid almost 2%. The drop had no characteristics of deeped sell-offs. Volatility generally remained low as measured by the VIX.

👉 𝙒𝙚𝙚𝙠𝙡𝙮 𝙟𝙤𝙗𝙡𝙚𝙨𝙨 𝙘𝙡𝙖𝙞𝙢𝙨 𝙘𝙖𝙢𝙚 𝙤𝙪𝙩 𝙖𝙗𝙤𝙫𝙚 𝙚𝙭𝙥𝙚𝙘𝙩𝙖𝙩𝙞𝙤𝙣𝙨 𝙤𝙣 𝙏𝙝𝙪𝙧𝙨𝙙𝙖𝙮. The number for preceeding week hit 853k vs. 730k expected. Weaker labour market data spurred renewed pressure on Washington to reach a consensus on new stimulus as soon as possible. The need for additional support was sounded out from different sources again.

👉 On Friday $DIS (Walt Disney) 𝙛𝙡𝙚𝙬 𝙝𝙞𝙜𝙝𝙚𝙧 𝙖𝙨 𝙞𝙩 𝙧𝙚𝙫𝙚𝙖𝙡𝙚𝙙 𝙗𝙪𝙡𝙡𝙞𝙨𝙝 𝙨𝙩𝙧𝙚𝙖𝙢𝙞𝙣𝙜 𝙥𝙧𝙤𝙟𝙚𝙘𝙩𝙞𝙤𝙣𝙨. ended up 13%. The media copmany expects to have 230-260m subscribers by 2024. The broad market still struggled though and indices ended lower for the third consecutive day.

👉 𝙀𝙛𝙛𝙚𝙘𝙩𝙞𝙫𝙚 𝙬𝙚𝙚𝙠𝙡𝙮 𝙞𝙣𝙙𝙚𝙭 𝙘𝙝𝙖𝙣𝙜𝙚𝙨: $SPX500 -1%, $NSDQ100 -1.2%, EuroStoxx600 -1%, $GER30 -1.4%, $JPN225 -0.4%.

𝗢𝘁𝗵𝗲𝗿 𝗺𝗮𝗿𝗸𝗲𝘁𝘀 𝗲𝘃𝗲𝗻𝘁𝘀:

👉 𝘽𝙤𝙣𝙙𝙨: the US yield curve (10y-FF) took a breather this week ending 85bps, the German curve (10Y Bunds-3M) currently at 11bps with 10Y Bunds at -0.63%, as their prices took a jump vs. last week. EuroArea AAA-rated bonds yield curve stands at 16bps. High Yield Spreads keep falling towards 4.

👉 𝘾𝙤𝙢𝙢𝙤𝙙𝙞𝙩𝙞𝙚𝙨 (𝙚𝙭 𝙤𝙞𝙡): Gold ($GLD) flat on week, Silver ($SLV) -1% on week. Not much action here.

👉 𝙊𝙞𝙡: added 1.3% and WTI hovers around $45-46

👉 𝘾𝙪𝙧𝙧𝙚𝙣𝙘𝙞𝙚𝙨: DXY (Dollar Index) up 0.3% on week, $EURUSD flat.

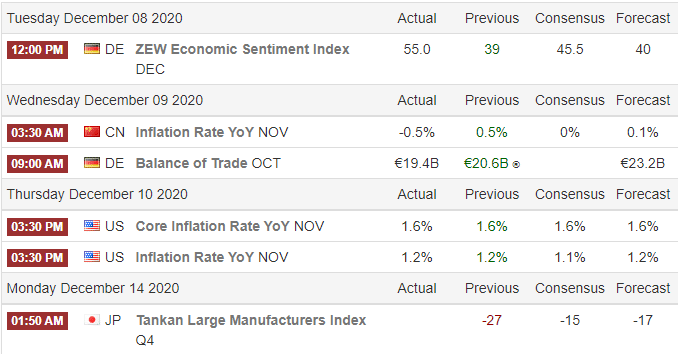

Major macro events: (times are CET; source: tradingeconomics.com):

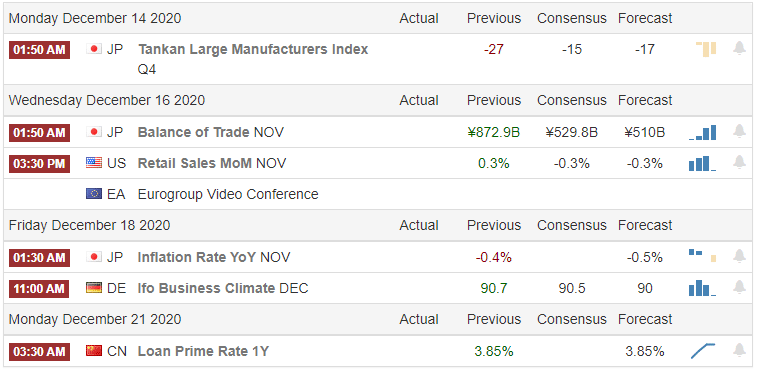

Next Week’s major macro events:

Best,

GlobalAlphaSearch.com

Disclaimers: None of the ideas, views and thoughts presented here shall ever be taken as a recommendation to buy or sell stocks,bonds,FX,commodities or any other financial instruments as stated in REGULATION (EU) No 596/2014 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC or the Polish Act of 10 February 2017 amending the act on trading in financial instruments and some other acts. The article is for educational reasons and purely presents private views of the author, thus the author shall not be held accountable for any losses of a third party resulting from any potential trading activities in any instruments, both specifically or by category of assets. The author uses his best knowledge and data from sources believed to be reliable, but makes no representations as to the accuracy of the data.Full Disclaimers&Liability Limitations page.